Today, I want to do an in-depth look at how much money, exactly, can I make with cryptocurrency mining, trading, and cloud contracts. I’ve look at a lot of different ways to mine the currencies, and today’s examination is a close look at what kind of real world value we are generating. If you’re here, you’ve probably read up on the basics on cryptocurrency, so I’ll just start with a very brief intro before digging in.

Cryptocurrency is a fancy name for digital money, or coins, that have gained tremendous popularity recently in the last few years. It’s not hard to create a digital currency, and therefore there are hundreds of coins out there, each with a different ecosystem surrounding it, but it is hard to get awareness, usefulness, value, users, adoption, etc. so there are just a few coins we are going to look at today: Bitcoin, Ethereum, Litecoin, DashCoin, and Monero. These are 5 coins that are very popular, have established value, and can be used at a variety of places to actually purchase something.

If you want a more detailed look at a cryptocurrency, check out my other post on Ethereum Mining : Digital Currency 101

Let’s dive in. Here are the ways in which you can make money with digital coins.

- Mine the coins with your personal computer, ASIC mining device, or mining rig

- Mine the coins with your device from above while participating in a mining pool

- Sell hashing power through a hashing service provider

- Purchase a mining contract from a hashing service provider

- Purchase the coins with real world currency and hold on to them in the hopes they appreciate in value.

Let’s tackle these 1 by 1 and see how much we can make

Mine the coins with your personal computer, ASIC mining device, or mining rig

First thing you need to know is the way mining works. Basically, all computers on the network are solving complex problems (hashes) at the same time, and whichever computer solves the hash first gets paid, and everyone else gets nothing. Yes, this seems really hard, because it is. Your computer is competing against every other computer in the world mining that currency, and only 1 person gets it. Your chances of getting a correct answer is very, very slim, and its only getting harder. Unless you have the startup capital to afford an incredibly high powered system ($10s to 100s of thousands of dollars) this type of mining is generally considered the worst way to mine. You can make some money, and you’ll get the correct answer sometimes (because there are a large number of hashes to be solved each day), but it’s inconsistent money, therefore it’s really hard to predict how often or how much you’ll get paid. Moving on to #2.

Mine the coins with your device while participating in a mining pool

The idea here is roughly the same as #1, except with one huge caveat. Your computer does exactly the same thing, but it participates in a network of other computers, whose power together is a much larger total, which means it has a much larger percent chance that it (the pool) solves the problem. Someone in the pool gets the right answer more frequently than you personally do. In this case, every computer in the pool receives a small cut based on the percent power they contribute to the pool. If someone solves it, and you contribute 1% of the pools total power, you get 1% of the total coins gained. (It’s not exactly that much, but that’s enough to get the picture)

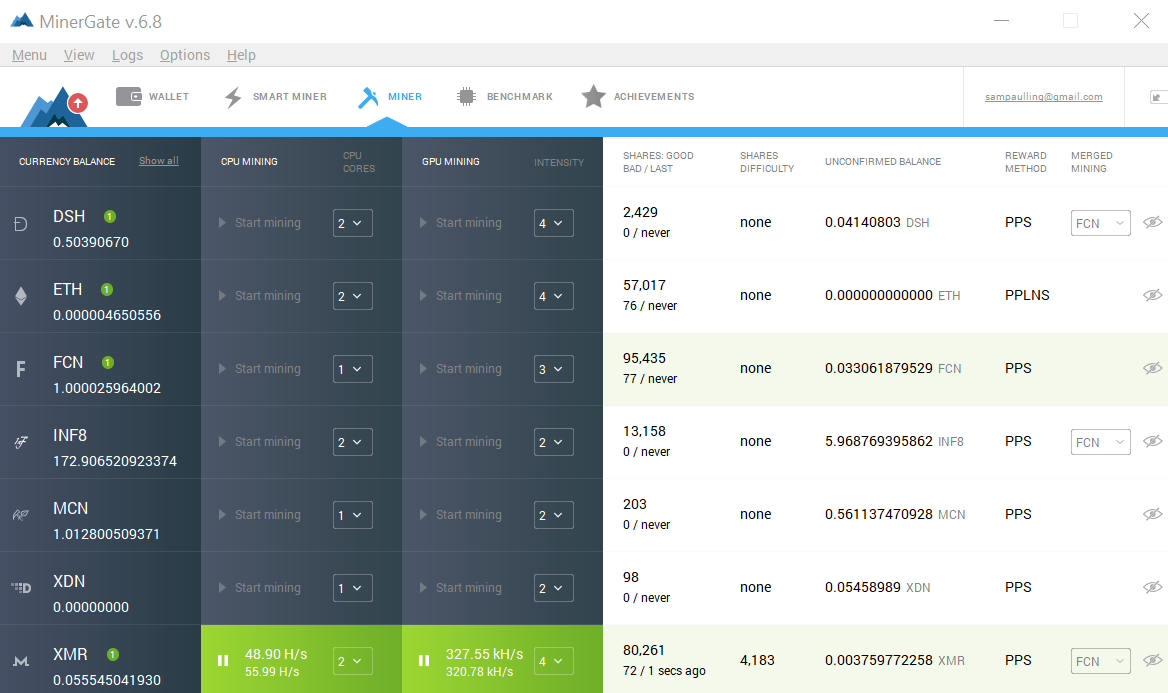

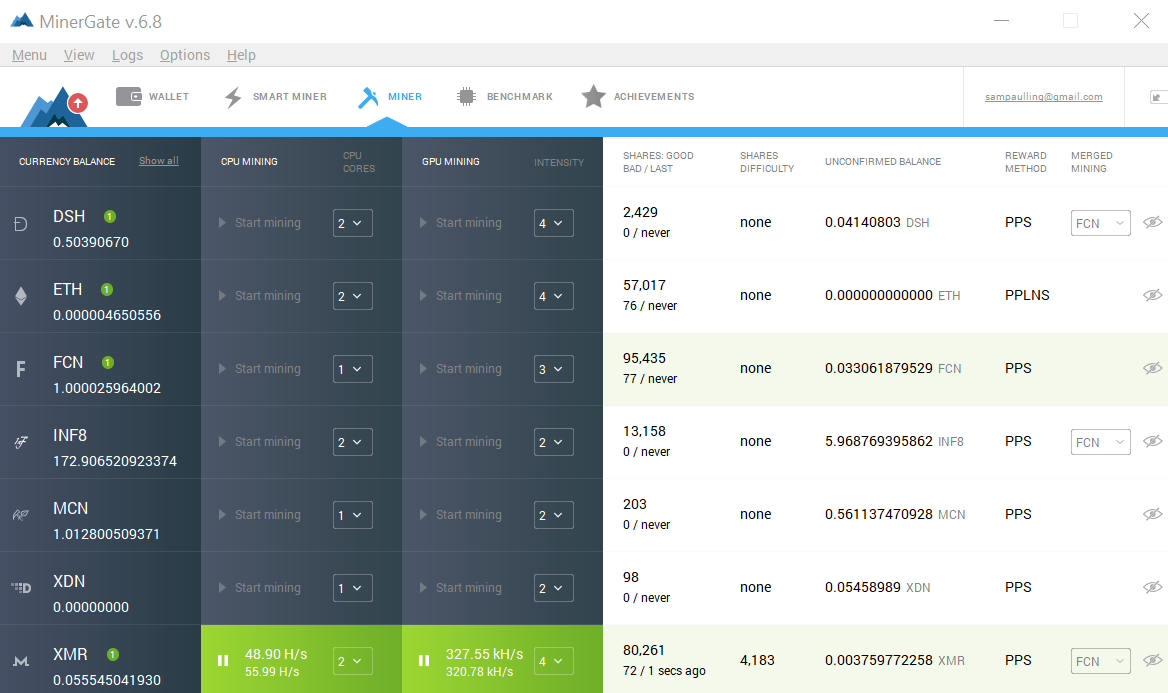

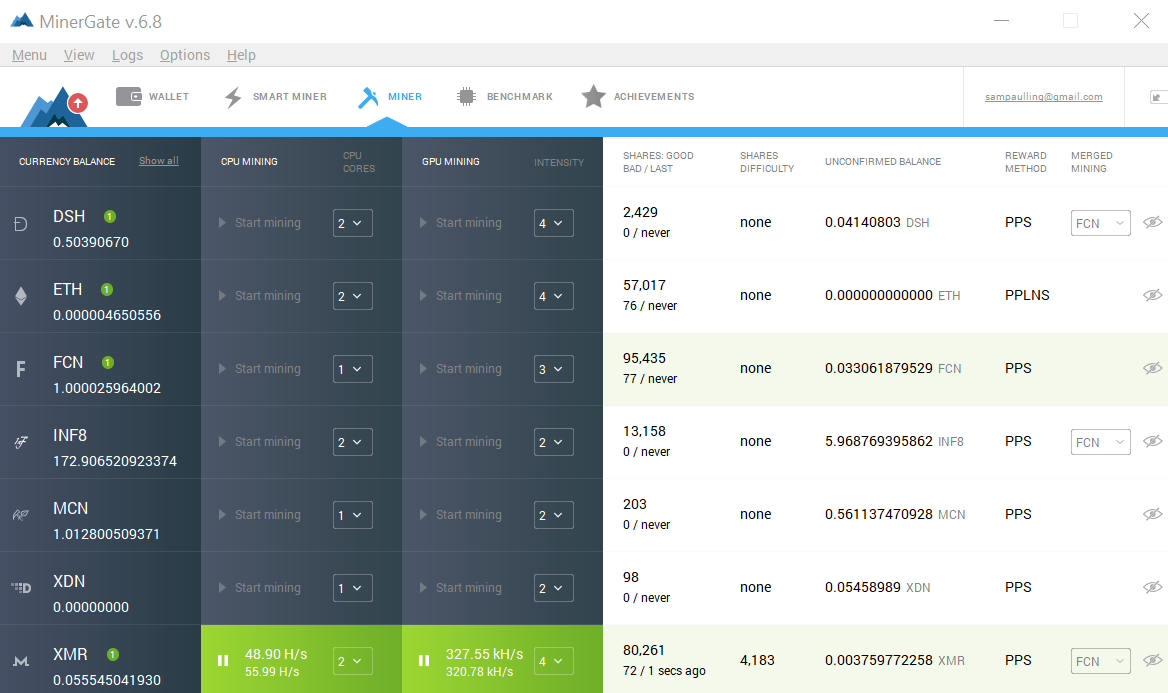

So how well can you do? Let me first say that I don’t have a fancy ASIC , a small device manufactured specifically for mining coins, because they are expensive, and I don’t have a mining rig consisting of multiple graphics cards, because they are really expensive, but I have a very powerful home desktop with an i5 processor and an overclocked GTX1060 6GB graphics card, so I can at least establish a baseline for entry level mining.

Using a mining program called MinerGate and mining for Monero (XMR), I can mine at a Hash Rate of 48 Hashes/sec with my CPU, and 560 H/s with my GPU. One of the first lessons you’ll learn about mining. It’s all about GPU power. It’s almost useless to mine on a CPU, almost.

I ran this program for nearly a week, so that I could get a baseline for how much XMR (Monero) I actually receive. Crunching numbers…. boring math…. I ended up earning about $0.04 / hr. ($0.96/day, $29.76/month) That’s really not much. But it is something for nothing, other than leaving my computer on, which I already do. This could offset the price of power, or just provide a steady stream of a small amount of coins.

Note: one huge caveat: This is 100% based on current pricing, and the model is mine it today, sell it tomorrow, which is not what you want to do. This isn’t going to be a quick turnover. If, instead, I mined 1 monero coin, today worth $98.61, and I hold onto it for a year, and its price doubles, then all of my mining was worth more than I thought, and I made twice that. It’s not uncommon for a currency to skyrocket in price, and then plummet back down, and then take off again. These currencies are unregulated (so far) and very volatile. So it’s really hard to predict the long term value of any of these.

If you’re interested in trying out this program for mining on with a group, use this link here and join with me! : MinerGate

Ok so unless I have lot of specialized equipment, its hard to justify leaving my computer on making very little headway or profit, so what else can I do?

Sell hashing power through a hashing service provider (cloud contracts)

Cloud contracts are a way for a casual user to get into mining without having to actually own any of the equipment, know how to set it up, pay for electricity, etc. You can participate in two ways: The first is to sell your computers hashing power to the site, who can then distribute it out to whoever wants to buy it, and you get paid a consistent amount, regardless of whether or not your computer solves anything. The second, which I’ll cover next, is buying hashing power from the cloud through a contract.

Cloud contracts are a way for a casual user to get into mining without having to actually own any of the equipment, know how to set it up, pay for electricity, etc. You can participate in two ways: The first is to sell your computers hashing power to the site, who can then distribute it out to whoever wants to buy it, and you get paid a consistent amount, regardless of whether or not your computer solves anything. The second, which I’ll cover next, is buying hashing power from the cloud through a contract.

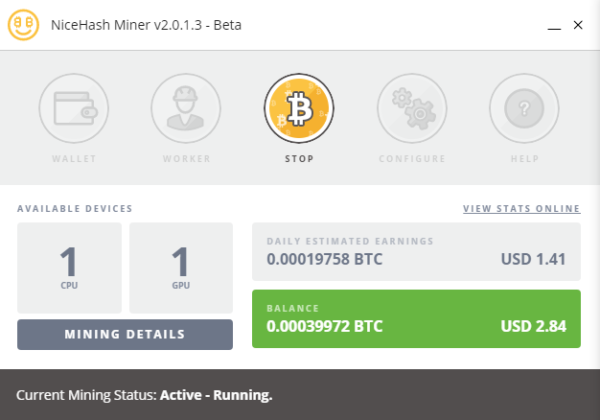

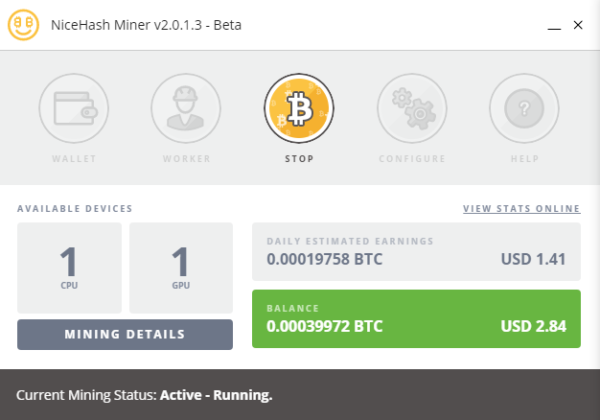

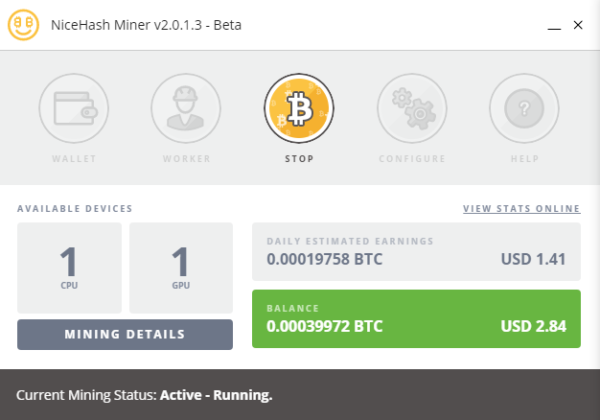

I used a different program, NiceHash Miner, to participate in the pool for a few days to see how my home desktop would do compared to just mining in a pool. The process is dead simple. Install the program, tell it which CPU and GPU to use (in my case I turned off CPU so I can still use the computer while its running) and let it go. A complicated looking window pops up telling you what it’s actually doing, but that doesn’t really matter as you don’t do anything with it.

Turns out, for me, this is more lucrative.

You can see in the screenshot that I make about $1.44 / day ($0.06/hour, or $36.94/month). Ok, so still not alot, but it is more, and more consistent, and I’m paid directly in Bitcoin, which has the most value and potential to increase currently of all the coins.

Buying hashing power through a hashing service provider

Now this is where things get to a much larger scale. Cloud contracts provide a huge amount of hashing power for X amount of money, and we’ll do an analysis on that, but let’s look at the benefits first.

Cloud mining providers can afford to do this because of two things: scale and location. They have tremendous capital and fill a warehouse with computers, all serving up processing power to users like you and me. They deal with the hardware, electricity cost, noise, heat, and downtime, and all we do is send them a check at the beginning and we are up and running a miner in no time. It’s incredibly easy. Significantly easier than building your own custom rig yourself, and actually not that much more expensive.

I’ve looked at two providers : NiceHash (the program I used to sell my power with) and Genesis Mining.

Nicehash is designed for quick, high power mining. A few days at a time. You browse their marketplace of different hashing algorithms and place an order for a ton of power, 10 GH/s minimum in some cases, and you set your amount of bitcoin to spend, and it will tell you how long it can run. To buy the minimum 10GH/s, with the minimum 0.005 BTC (~$35 US Dollars), you can run the miner for 2hrs 51min. That gives you a lot of power to compete with for a short amount of time, but that seems riskier to me, so I also took a look at Genesis Mining.

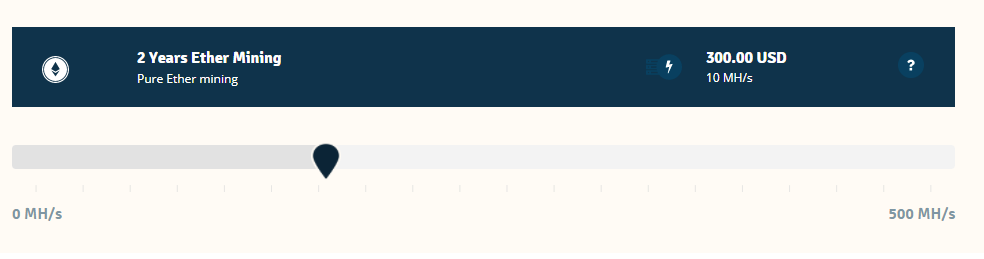

Genesis Mining allows you to pay one time, up front, for X amount of hashing power for different types of coins, and the contract lasts for 2 years. So you are guaranteed 2 years of that kind of power once you pay to start. That sounds good to me, even though its a lot less power than what you get at NiceHash.

A 2 year Ethereum mining contract starts at $30 for 1MH/s, and 2 years of Monero mining contracts start at $50 for 60H/s (a very different scale, dont compare the ethereum power to the monero power, as each currency has very different requirement for solving 1 hash, so one currency may take a whole lot more power than another.)

I am going to start a mining contract today and come back and edit this post later on down the road with how its going, but to get at least some kind of a baseline, I watched some youtube videos about this process and calculated some numbers from what I saw on their screens.

I am going to start a mining contract today and come back and edit this post later on down the road with how its going, but to get at least some kind of a baseline, I watched some youtube videos about this process and calculated some numbers from what I saw on their screens.

One high spending individual has a total of 151 MH/s of Ether, and 1010 MH/s of Dashcoin. He reports that his daily profit is $19 for the Ethereum and $34 for the Dashcoin, and I calculated his initial costs for the contracts at $4200 for the Ethereum and $4500 for the Dashcoin.

Therefore, his recoup time is 221 days for the Ethereum and 132 days for the Dashcoin. After that, he is making profit for the remainder of his 2 year contract.

With his remaining time, he stand to make $9671 from his Ethereum contract and $20,332 from his Dashcoin contract. (Yes, I know this is likely a high estimate, as difficulty for solving goes up over time, requiring more hashing power, therefore the contract generates less and less money over time, but I dont have the time now to figure all that out).

That being said, his initial $8,700 investment could net him nearly $21,000 over two years, which is really pretty great, as long as we don’t think too hard about all the possible things that could go wrong with the currencies, the company selling the contracts, and a whole host of other things that might totally crater his investment. This is, and always will be, a risky place to put money, and one should never invest money here in cryptocurrency that you cant afford to lose.

If you’re interested in purchasing a cloud mining contract, head on over to Genesis Mining and use my affiliate code : uiUQrm

You’ll get a 3% discount on any plan you purchase!

Let’s take a quick look at the last possible way to make money:

Purchase the coins directly through a broker and hold on to them

Every other method here describes a way to generate coins, and this is honestly the easiest and most reliable. Simply go to an online broker/coin exchange, put in your credit card number, and they will send you that amount of whatever coin you want directly to your wallet, based on the current exchange rate. If you have the money, do this, as it’s far less headache and waiting. You have the coins now, safe in a wallet on your computer (which you should definitely be backing up now) and you are just waiting for the price to rise, hopefully. This is the same thing as purchasing a bar of silver and hoping the price of silver goes up and turning a profit. The advantage here is that this value is completely subjective and has a tendency to dramatically rise and plummet based on a whole host of factors. I could honestly do a whole, huge post on just how that works, but there is a ton of information about this already out there that you can easily find if you are so interested.

I’ll say this: most cryptocurrencies are enjoying a meteoric rise in value due to a large trend of the media pushing stories about them. Bitcoin has been around just shy of a decade now, and most folks are only now just hearing about it. Ethereum has been used for years in nerdy circles to generate shared computing resources for app development, but is still in its infancy in terms of the average population even hearing about it. There are literally hundreds of coins out there, most of which I haven’t even come across yet in all the research I’ve done for this article, and all I can say is that this space is ripe for a whole lot of people making a lot of money, and a whole lot of other people getting ripped off through cryptocurrency madness and ponzi schemes. Be careful which coins you invest in, do your research, and jump in! If you pick the right coin, you stand to make a tremendous amount of money in a short amount of time! But be realistic. Investing in the early days of bitcoin could have easily made you a millionaire today with less than $1000 invested at the beginning, but that doesn’t mean that every cheap coin you see now will do the same. Bitcoin was the first, is the biggest, and that ship has sailed. Now that cryptocurrency is more and more mainstream, I think we will see a leveling out of how much these coins increase, or we will see a dramatic bubble being popped.

Either way, it’ll be fascinating.

So get involved, do some learning, and have some fun. Take some risk, but keep it appropriate, and who knows, maybe you’ll end up on the winning side of a coin’s rise to the top!

Support us on Patreon!

I hope you've enjoyed this tutorial! Please consider donating on our Patreon page! The more money we raise, the bigger and more elaborate project tutorials we can do for you!

Check out the Patreon Page